Malaysia Car Road Tax List

BMW M5 Road Tax Price List. Heres a look at just how much excise tax you can be charged for passenger vehicles in Malaysia.

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Fully imported CBU from Japan there are two variants of the MX-30 announced which are the Mid and High variants though only the latter.

. Car variant Peninsular Malaysia Region Individual Owned Car. Harga Proton Persona 2022 di Malaysia Varian Harga RM 16 Standard AT 47800 naik RM 2000 16 Executive AT 53300 naik RM 2500 16 Premium AT 58300 naik RM 2500 Dilancarkan bersama Iriz Proton Persona MC2. Whether the car is diesel or petrol.

The road tax Porsche Taycan Turbo S locally for instance costs a hefty RM 12094 every year while Malaysians with a dream of owning a lightning-fast Tesla Model S Plaid will be starring down the barrel of an annual road tax bill that totals RM 17862. It is the excise tax. 2022 BMW M5 Road Tax Price.

The Road Transport Department was set up to coordinate all aspects of transportation across the state. Two months after it was previewed to the media Bermaz Motor launched the 2022 Mazda MX-30 at an event in 1 Utama alongside the Mazda CX-8 25T. Aside from the pioneering Nissan Leaf over the past year we have seen multiple high-profile EVs such as the Porsche Taycan from RM7504 per year in road tax and most recently the BMW iX from RM3063 per year in road tax make their local debuts.

Ad View Tax Expiry Full MOT Details History More. 2022 Proton X70 15 TGDi Standard 2WD Road Tax Price. In this case it would be on the imported car.

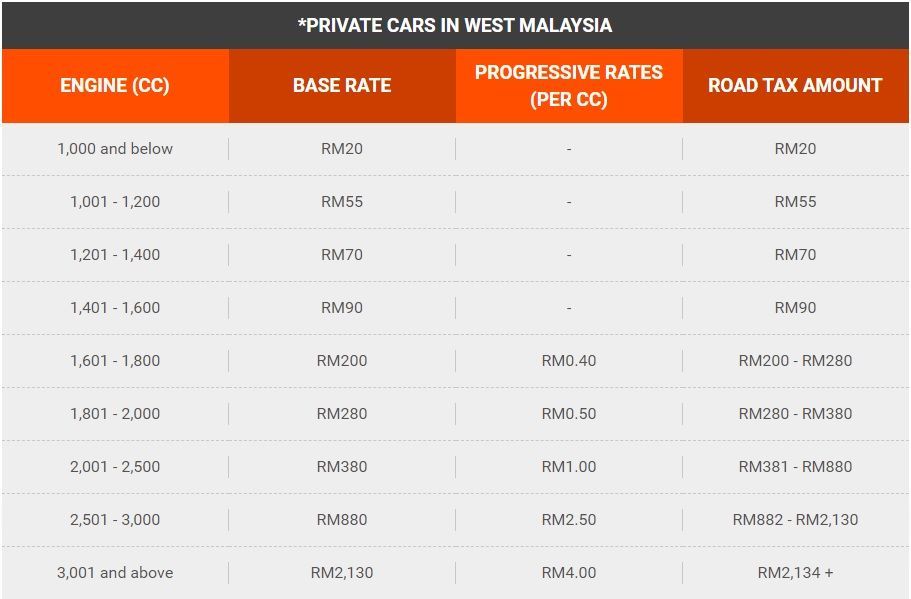

It is subject to between RM20 and RM90 which is set by the Road Transport Department Malaysia JPJ. The fixed ERP fee will be deducted through your. In Malaysia car insurance is compulsory and road tax also has to be paid by car owners.

Malaysia-registered cars can pay a fixed rate of 5 daily to use ERP-priced roads during ERP operating hours regardless of the number of times the vehicle passes through ERP gantries within the same day. Taking the same Camry 25 again a higher base rate of RM760 is charged together with a progressive rate of RM3 per additional cc over 2000 cc. Motor Vehicle License LKM rates calculation guidelines for vehicles in Peninsular Malaysia Sabah and Sarawak is in this link.

Youll find prices specifications warranty details high-resolution photos expert and user. Above 80 kW to 90 kW RM165 and RM017 sen for every 005 kW 50 watt increase. If so please take a look at the road taxation amount tables.

Check Your Car Now. Calculation results are based on conditions. Motor Vehicle License LKM rates calculation guidelines for vehicles in Peninsular Malaysia Sabah and Sarawak revised after the 2009 Budget.

LKM Rates Calculation Guidelines. Priced from RM 199k 2022 Mazda MX-30 EV launches in Malaysia. The road tax rate is calculated as follows starting with a base rate and an additional rate for each kW increase.

Excise tax is an additional tax that needs to be paid when purchases are made on a specific item or good. Below 16L The annual road tax amount for cars below this engine capacity is fixed. List the price range according to these different factors and link externally to the JPJ website.

At long last the T62 generation all-new 2022 Ford Ranger has been launched in Malaysia by local distributor Sime Darby Auto Connexion SDACFor Malaysia 6 double-cab variants are available with the following prices. Proton X70 Road Tax Price List. Car variant Peninsular Malaysia Region Individual Owned Car.

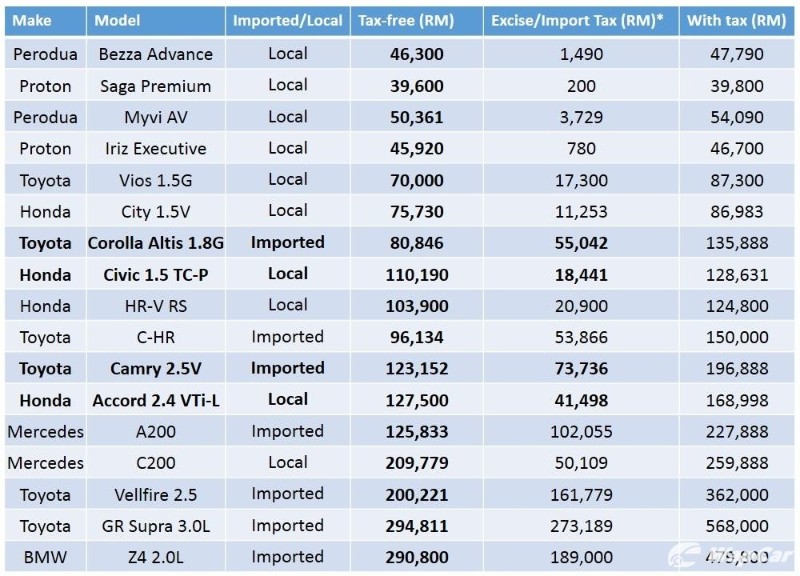

The larger a vehicles engine the more road tax is payable. For instance the total tax charges for a Toyota Vellfire could come up to about RM110000 before exemption ballooning the on-the-road price to RM382300 25L model. Calculation results are based on conditions.

Road Tax for Electric Vehicle JPJ Road Tax for Commercial Vehicles. And thats not even counting the insurance amount which would probably cost you that iPhone 5 youve been so eagerly waiting. On Sale Not On Sale.

Road tax is used to pay for maintaining the road network nationwide. Above 16L Cars that are above 16L or 1600cc will be charged to a maximum of RM200 per vehicle. On Sale Not On Sale.

All-new 2022 Ford Ranger launched in Malaysia - 6 variants from RM 108k Wildtrak from RM 168888. Enter Your Reg Plate To Access Your Vehicle Information Plus Ways To Renew. RM760 RM1482 RM3 x 494 totals up to RM2242.

The amount of road tax depends on the following factors. Latest JPJ formula - calculate how much your vehicles road tax will cost. Combined with the 10 sales tax tax charges for cars can come up to quite a substantial amount making Malaysia one of the countries with the highest tax on cars globally.

Road Tax for Commercial Vehicles JPJ. So a 35litre Nissan 350Zs road tax would cost you an additional 3 months of your monthly repayment assuming you took a 7 year full loan.

All You Need To Know About Road Tax Classic Car Status Insights Carlist My

Road Tax Suv Mpv Pickup Peninsular Paul Tan S Automotive News

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Comments

Post a Comment